|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Understanding Pet Insurance in Illinois: A Comprehensive GuideIn recent years, pet insurance has become an increasingly popular choice among pet owners in Illinois. As more people recognize their pets as cherished family members, they are also beginning to see the value in safeguarding their furry friends' health. The world of pet insurance, however, can seem daunting at first glance. It's a tapestry of terms, coverage options, and fine print that can easily overwhelm even the most diligent pet parent. But fear not, as navigating this complex landscape can be made simple with the right guidance and a touch of insider knowledge. First, it's essential to understand what pet insurance actually covers. In Illinois, as in most states, pet insurance policies typically provide coverage for accidents and illnesses, and some offer wellness plans as an add-on. However, the scope of coverage can vary significantly from one provider to another. Therefore, a thorough comparison is crucial. Accident-only policies are generally the most affordable but offer limited coverage, usually focusing on injuries resulting from unforeseen incidents such as car accidents or ingesting foreign objects. On the other hand, comprehensive plans often cover a wider range of scenarios, including chronic conditions like diabetes or arthritis, which can be crucial for breeds prone to genetic health issues. While evaluating potential policies, consider the deductibles, reimbursement levels, and annual limits. These factors can drastically affect the out-of-pocket costs and overall affordability of a plan. A higher deductible might lower your monthly premium, but it also means you'll pay more upfront before the insurance kicks in. Reimbursement levels, which generally range from 70% to 90%, determine how much you'll get back after paying a vet bill. Some plans also impose annual limits on payouts, which can be a significant consideration if your pet requires ongoing treatment. Another critical aspect to consider is the insurance company's reputation and customer service. In Illinois, where options abound, it's worth researching online reviews, seeking recommendations from local veterinarians, and even asking fellow pet owners about their experiences. A company that offers excellent customer support and a straightforward claims process can make a world of difference during stressful times when your pet requires urgent care. It's also wise to consider the age and breed of your pet when selecting a policy. Younger pets generally have lower premiums and fewer pre-existing conditions, making early enrollment advantageous. Certain breeds, however, are predisposed to specific health issues, which can affect coverage options and costs. For instance, a purebred dog might face higher premiums than a mixed breed due to genetic health predispositions. For those living in Illinois, there's an added advantage to purchasing pet insurance: peace of mind amidst the unpredictable Midwest weather. Whether it's a harsh winter storm or a sweltering summer day, having a solid pet insurance plan ensures that your companion receives timely medical attention without the added stress of financial strain.

In conclusion, while pet insurance might seem like a daunting investment, it can be a lifesaver for both you and your pet in the long run. By doing your due diligence, comparing policies, and considering your pet's specific needs, you can find a plan that offers the best balance of coverage and cost. Remember, the ultimate goal is to ensure that your furry friend receives the best possible care, no matter what life throws their way. With the right policy in place, you can enjoy the companionship of your beloved pet with the peace of mind that comes from knowing you're prepared for any eventuality. https://www.illinois.gov/news/press-release.8747.html

The Department offers the following advice to consumers interested in pet health insurance: Review Your Options and Compare Benefits Among Policies. https://www.lemonade.com/pet/explained/illinois-pet-insurance-guide/

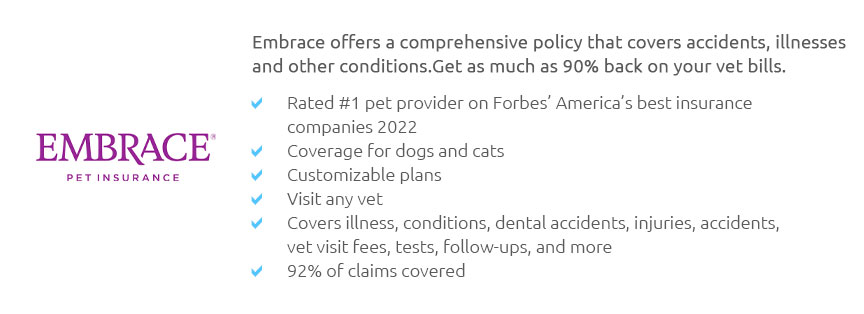

Yes, since we work on a reimbursement basis you can use your Lemonade pet insurance policy at any licensed vet in the U.S., including Illinois. https://www.embracepetinsurance.com/state/pet-insurance-illinois-il

Get top-rated pet insurance for dogs and cats in Illinois with Embrace. Up to 90% back on all vet bills. No network, visit any vet.

|